On This Page

Ireland Working Day Use Cases

Scenario-driven walkthroughs that show how to apply Irish working-day rules in real matters. For the underlying rule logic, see the technical reference. For in-depth guides and edge cases, browse Articles.

Purchaser's Solicitor:

Calculate Deadline to Raise Title Queries

Scenario

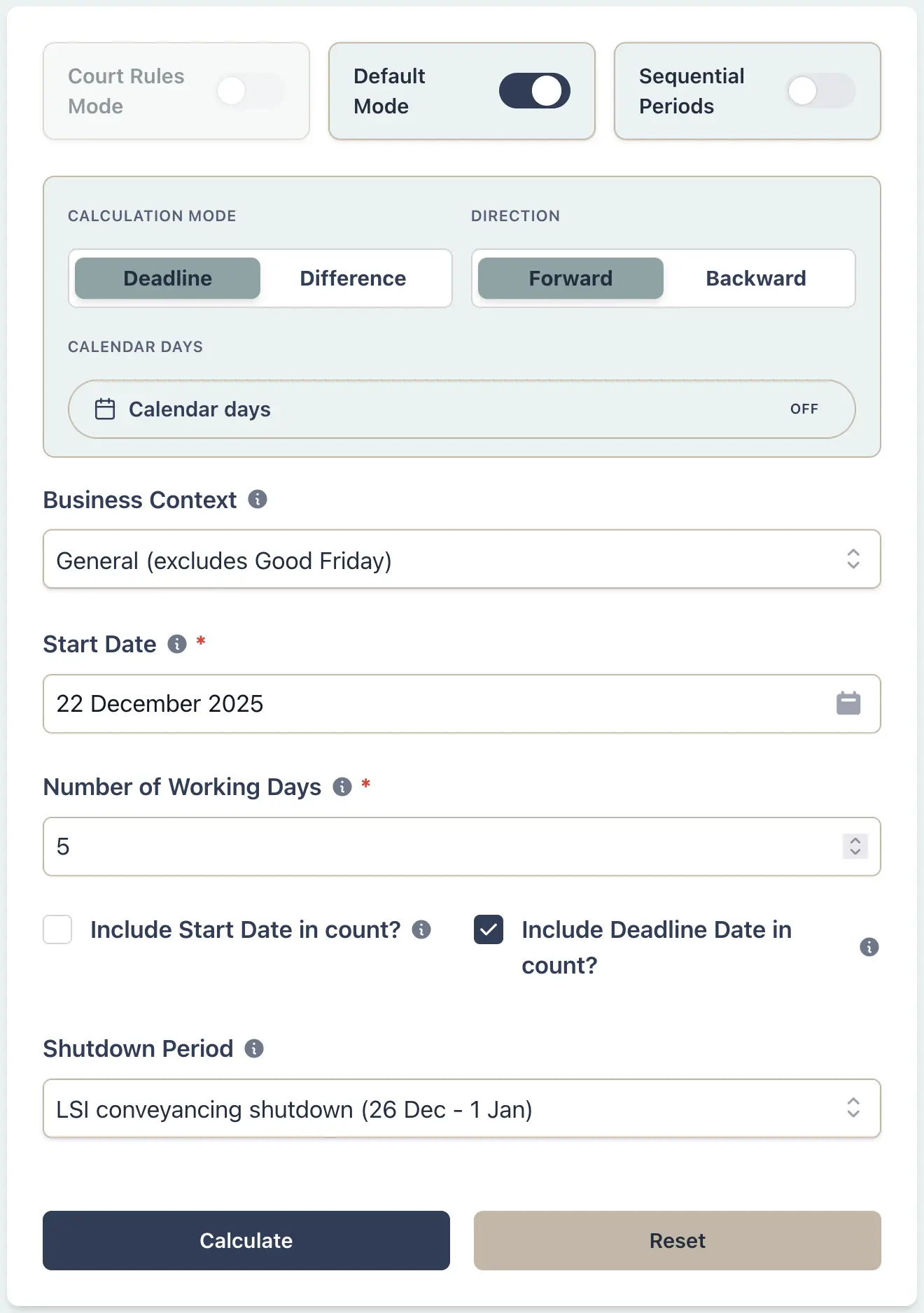

You are acting for a purchaser in a residential property transaction. On 22 December 2025, you receive the complete title documents, draft contract, and vendor's replies to initial requisitions from the vendor's solicitor. Under the Law Society General Conditions of Sale (2019/2023 Edition), your client has only 5 working days to raise any additional queries or rejoinders on the title. After this deadline, any unraised issues are deemed waived under the Pre-Contract Investigation of Title (PCIT) system. Because this spans the Christmas shutdown, you need to apply the Law Society exclusion period to calculate the exact deadline.

Example Workflow

Result Example

Documents Received: 22 December 2025 (Monday)

Query Deadline Period: 5 working days (PCIT system)

Working Days Counted: 23 Dec (Tue), 24 Dec (Wed), 2 Jan (Fri), 5 Jan (Mon), 6 Jan (Tue)

Final Deadline: 6 January 2026 (Tuesday)

Any title queries or rejoinders must be submitted to the vendor's solicitor by close of business on 6 January 2026. After this deadline, under the Law Society General Conditions of Sale (PCIT rules), any unraised queries are deemed to be waived and cannot be raised later. The Christmas shutdown (26 Dec–1 Jan), weekends, and public holidays are automatically excluded from the 5 working day count.

Why This Matters

- •Calculate the exact working day deadline for raising title queries under the PCIT system

- •Understand the 5 working day limit under Law Society General Conditions of Sale

- •Avoid waiving title objections by missing the critical deadline

- •Account for weekends, public holidays, and the LSI conveyancing shutdown period

- •Provide clients with clear notice of the time-critical query deadline

Legal Professional:

Calculate Notice of Motion Service Deadline

Scenario

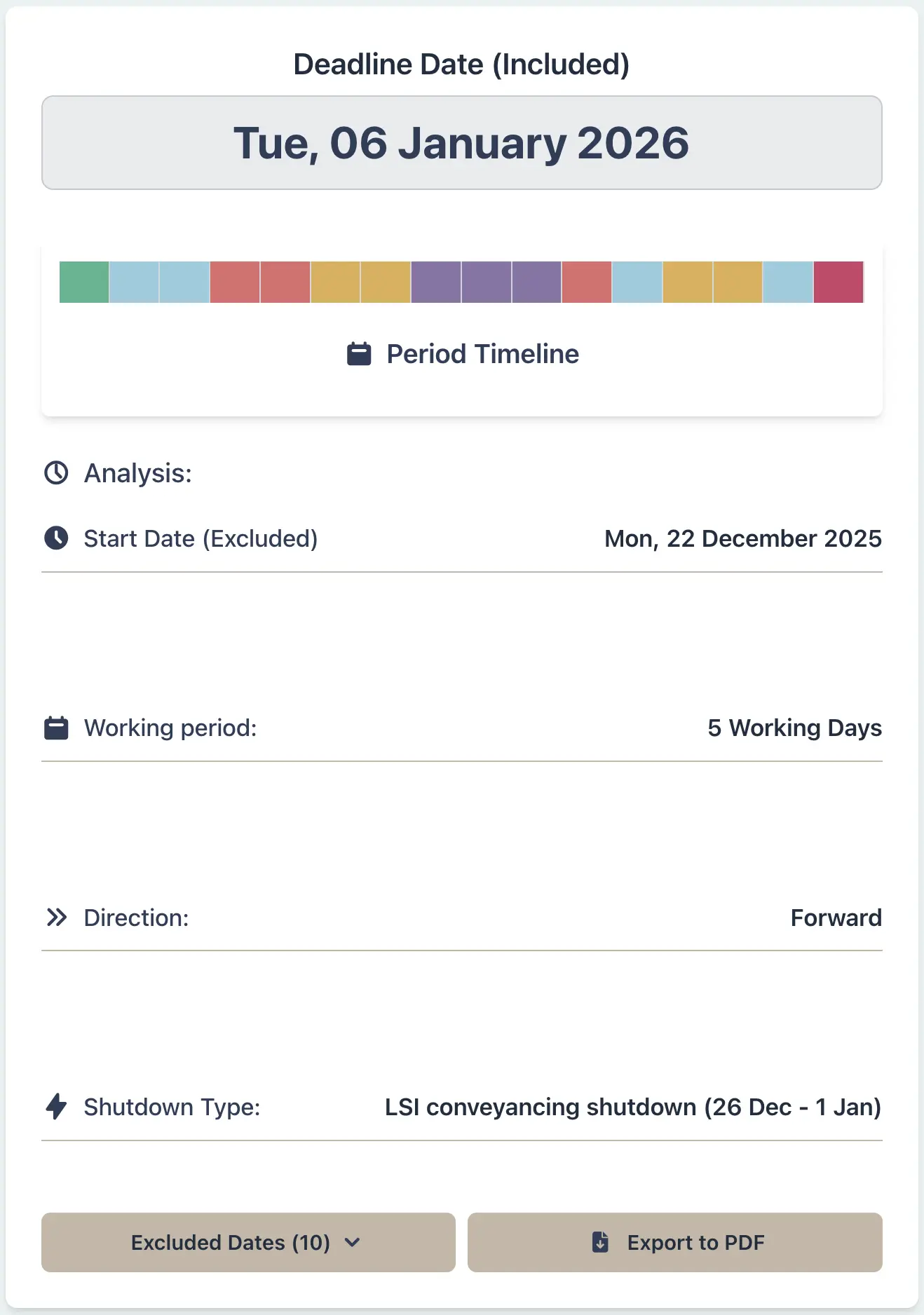

You are a solicitor bringing a motion in the High Court listed for hearing on 22 April 2025 (Tuesday after Easter). Under RSC Order 52, you must serve the notice of motion on the respondent at least 4 clear days before the hearing if serving personally outside court. Because this is a short period (less than 6 days), RSC Order 122 Rule 2 requires that Saturdays, Sundays, Christmas Day, and Good Friday are excluded from the calculation. You need to determine the latest date by which service must be effected to ensure your motion proceeds.

Example Workflow

Result Example

Hearing Date: 22 April 2025 (Tuesday)

Service Requirement: 4 clear days (personal service outside court)

Short Period Rule Applied: Excludes Sat, Sun, Christmas Day, Good Friday (only)

Latest Service Date: 14 April 2025 (Monday)

Counting back 4 clear days from the hearing: 21 Apr (Mon—Easter Monday, still counted), 17 Apr (Thu), 16 Apr (Wed), 15 Apr (Tue). Good Friday (18 Apr) and the weekend (19-20 Apr) are excluded, but Easter Monday IS counted under Order 122. Service on 14 April gives 4 clear days before the 22 April hearing.

Why This Matters

- •Accurately calculate RSC Order 122 service deadlines for Superior Courts motions

- •Automatically apply short-period rules (< 6 days excludes Sat, Sun, Christmas Day, Good Friday)

- •Understand the 'clear days' concept - ensuring sufficient time between service and hearing

- •Avoid having your motion struck out for insufficient notice

- •Provide clients with precise, legally-correct service deadlines

HR Manager:

Calculate Employment Termination Notice Period

Scenario

You are an HR manager at an Irish company needing to terminate an employee's contract. The employee has been employed for 4 years continuously, so under the Minimum Notice and Terms of Employment Acts 1973-2005, they are entitled to 2 weeks' notice of termination. You gave notice on 17 March 2025, and need to calculate the exact date the notice period expires and the employment terminates. Under Irish law, statutory notice periods run in calendar weeks, meaning weekends and public holidays count towards the notice period (they are not excluded). This calculation is critical to ensure the company complies with employment law and avoids potential disputes.

Example Workflow

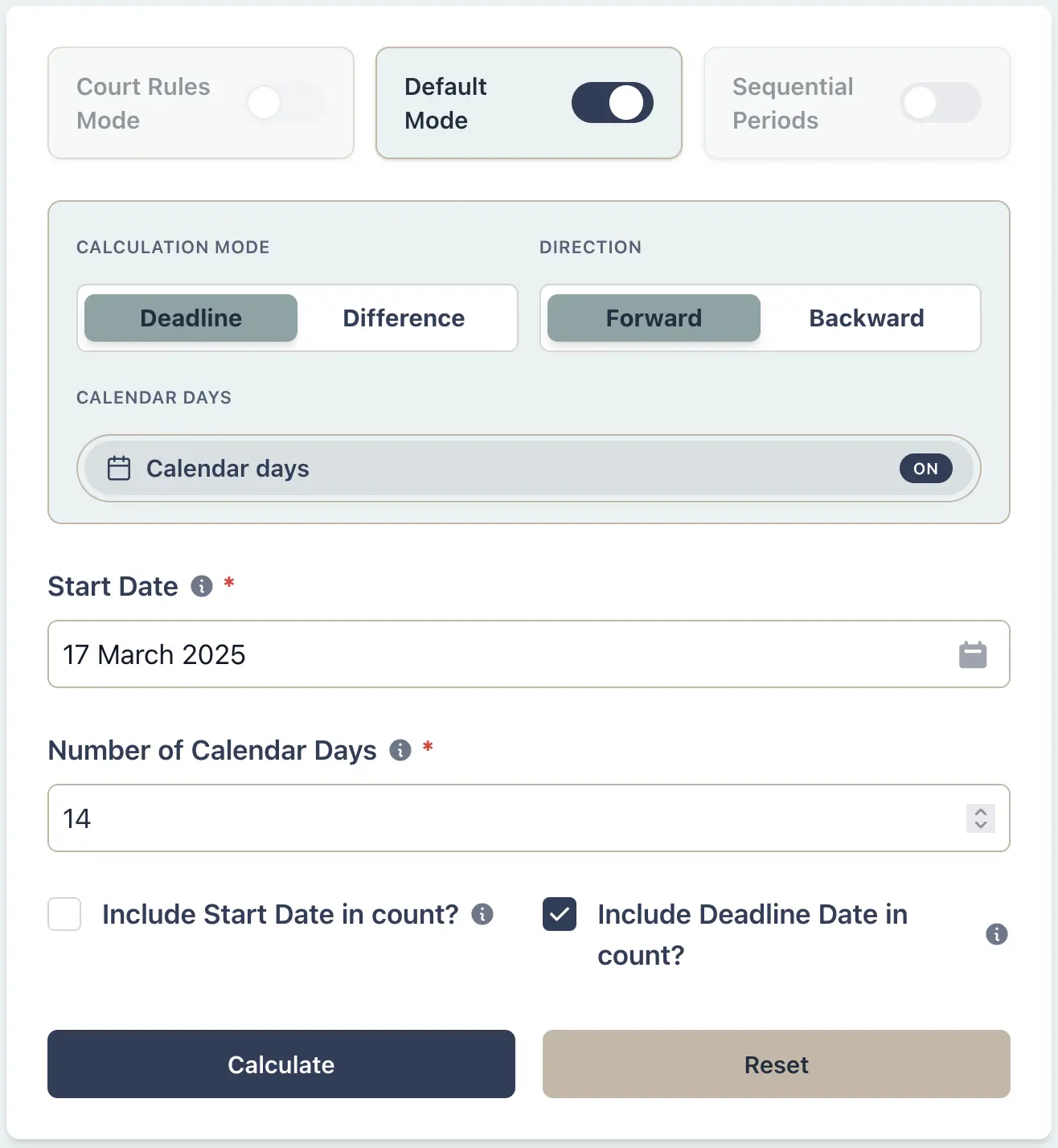

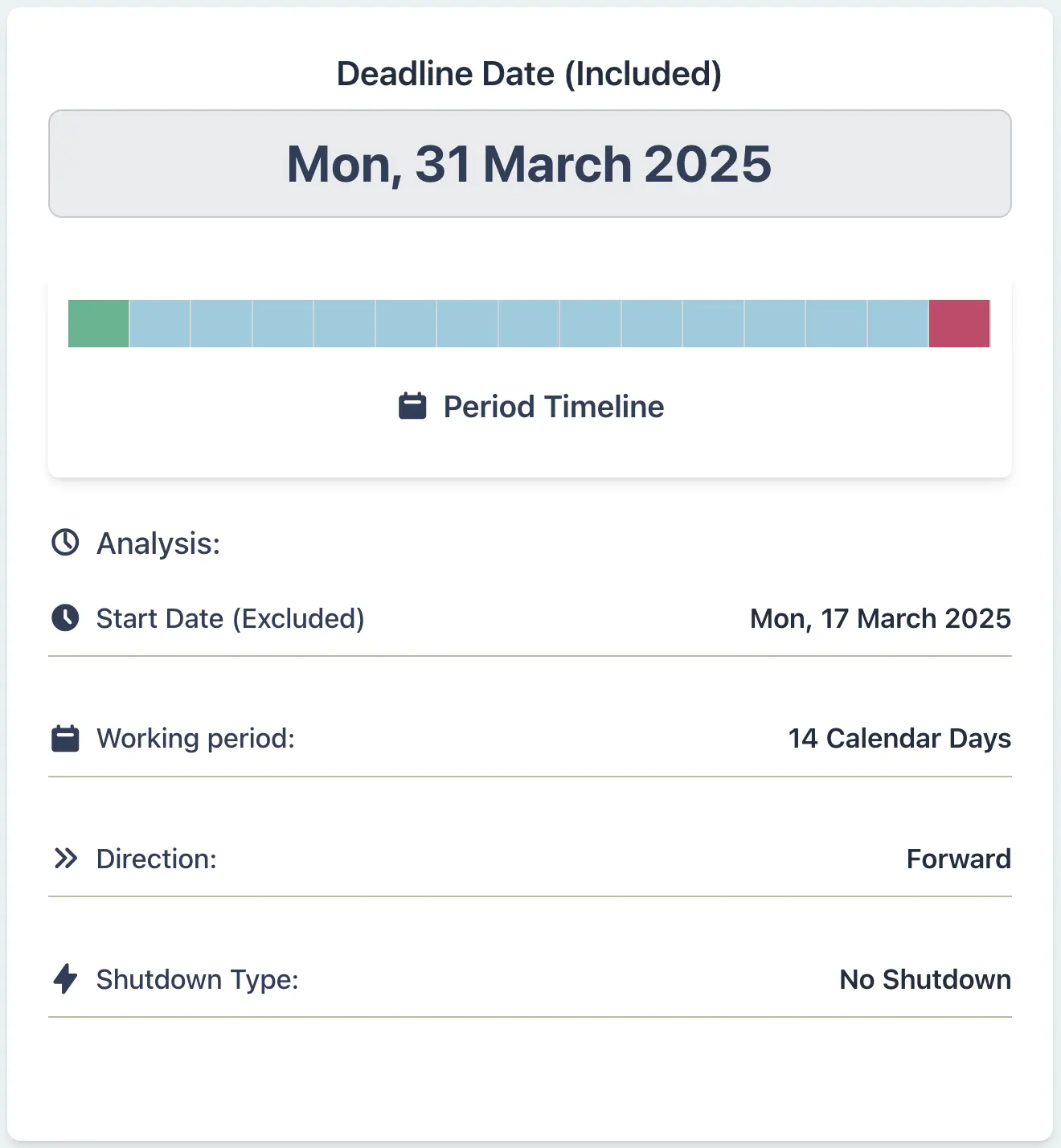

Result Example

Service Length: 4 years (continuous)

Statutory Notice Entitlement: 2 weeks

Notice Given Date: 17 March 2025 (notice period starts 18 March)

Termination Date: 31 March 2025

The 2-week notice period counts 14 calendar days. Weekends and public holidays are included in the count - they do not extend the period. The employment terminates at the end of 31 March 2025. The employee is entitled to be paid for the notice period and any accrued annual leave (minimum 4 working weeks per year under the Organisation of Working Time Act 1997).

Why This Matters

- •Ensure compliance with statutory minimum notice periods under the Minimum Notice and Terms of Employment Acts 1973-2005

- •Avoid wrongful dismissal claims by calculating accurate notice expiry dates

- •Determine the exact calendar date when the notice period expires (weekends and public holidays count towards the period)

- •Calculate entitlements to notice pay and accrued annual leave at termination

- •Provide employees with clear, legally-compliant termination dates

Construction Contractor:

Calculate RIAI Payment Certificate Timeline

Scenario

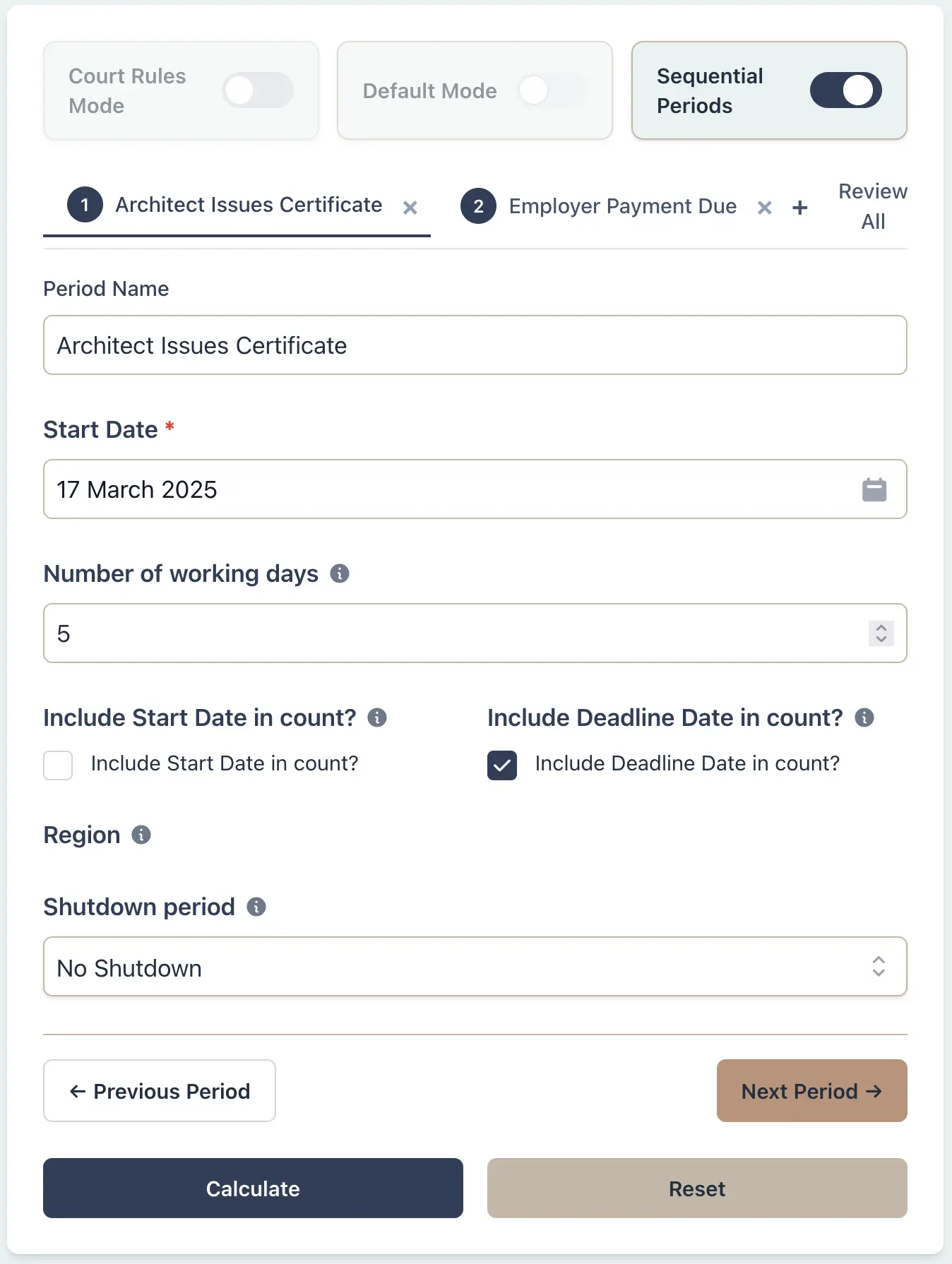

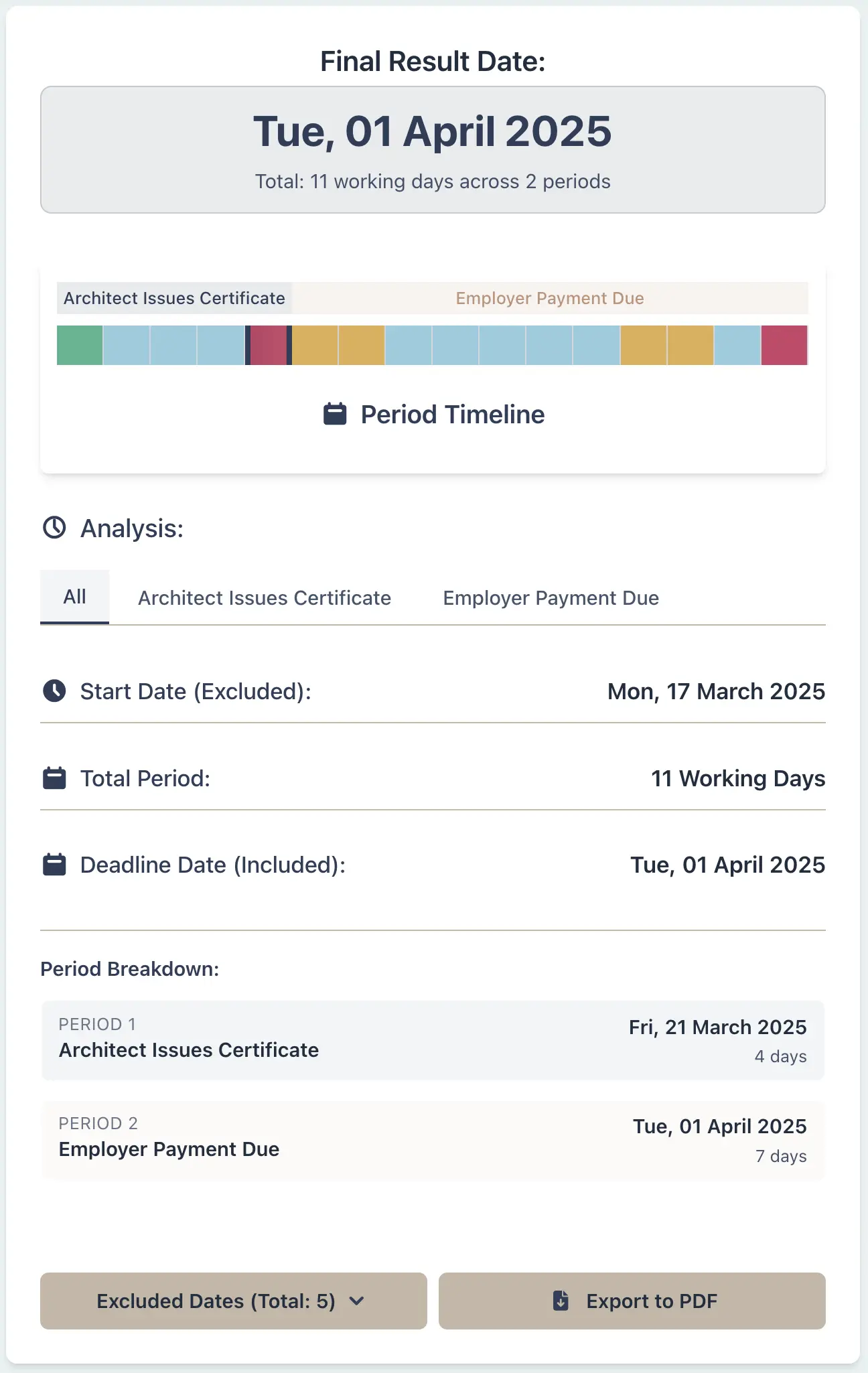

You are a contractor working under an RIAI standard form contract (2017 Edition) in Ireland. On 17 March 2025, you submit your monthly progress statement to the architect. Under RIAI Clause 35B (2017 Edition), the architect must issue a payment certificate within 5 working days of receiving your statement. Once the certificate is issued, the employer must pay within 7 working days. These timeframes were updated in the 2017 Edition to comply with the Construction Contracts Act 2013. You need to calculate when payment is due, accounting for the fact that under RIAI Clause 1(e), Saturdays, Sundays, and public holidays are excluded from working day calculations.

Example Workflow

Result Example

Progress Statement Submitted: 17 March 2025 (Monday, St Patrick's Day - public holiday)

Architect Certificate Due: 25 March 2025 (5 working days, excluding St Patrick's Day and weekends)

Employer Payment Due: 3 April 2025 (7 working days after certificate)

The sequential calculator shows both periods chained together. St Patrick's Day (17 March) is a public holiday and excluded from the count. The 5 working days for the certificate run from 18-25 March (excluding weekends). The 7 working days for payment run from 26 March - 3 April (excluding weekends). Total: 12 working days from submission to payment due.

Why This Matters

- •Accurately calculate RIAI contract (2017 Edition) payment deadlines under Clause 35B

- •Understand the sequential timeline: submission → certificate (5 working days) → payment (7 working days)

- •Automatically exclude Saturdays, Sundays, and Irish public holidays (per RIAI Clause 1(e))

- •Ensure compliance with the Construction Contracts Act 2013 payment regime

- •Avoid payment disputes by providing clear, contract-compliant deadline dates